Stanbic IBTC Holdings, commonly referred to as Stanbic IBTC, is a financial service holding company in Nigeria with subsidiaries in banking, stock brokerage, investment advisory, pension and trustee businesses. Stanbic Investment Banking & Trust Company Plc (IBTC) was formed as an investment bank.

Advertisement

Stanbic IBTC pension

Stanbic IBTC online banking

Follow these steps if you want to register for Stanbic bank IBTC online banking in Nigeria.

1. Open your browser on your or computer and make sure you have internet, visit the Stanbic bank Nigeria website here https://www.stanbicibtc.com/Nigeria

2. On your right side of the site where you see online banking, click on the arrows in front of it.

3. The secured website of Stanbic bank will open for you.

4. Click o “Register for internet banking”.

5. Enter your Stanbic IBTC account.

6. Click on Terms and conditions and Read carefully.

7. Make sure you have understood it.

8. After reading if you still wish to register, tic the small empty box.

9. Now, click on “Next.”

10. The next page procedures are crucial, so make sure you take your time and provide each detail correctly.

11. Follow the instructions thoroughly and complete your registration process.

12. Once your request is approved, your account will be set up, and you ready to use it.

That is how you can register for Stanbic IBTC online banking in Nigeria.

Now that you are registered and have your login details, the next thing so to log in.

Advertisement

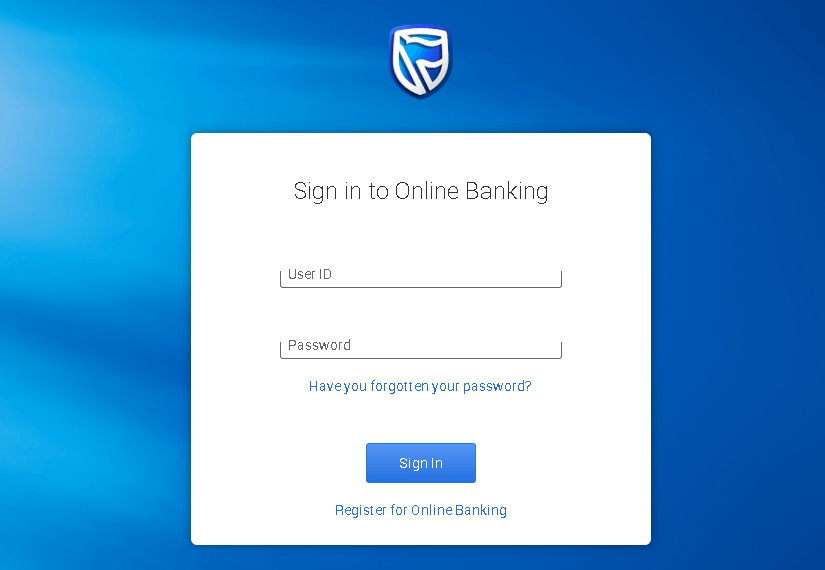

HOW TO LOG INTO STANBIC IBTC ONLINE BANKING ACCOUNT IN NIGERIA

Here are the steps you must follow if you want to log into your Stanbic IBTC online banking account:

- Visit the Stanbic IBTC online banking website here https://ibanking.stanbicibtcbank.com/roa/#/Login.

- Enter your User ID.

- Type your password.

- Check if you entered the correct bank login details.

- Now click on the “Login” button to sign in to your Stanbic Bank Nigeria online banking account.

Your internet banking account will open for you instantly.

Stanbic IBTC transfer code

If you want to use the mobile transfer on Stanbic IBTC to transfer money, follow the following steps: On your mobile phone registered for Stanbic bank transfer code dial *909#.

Stanbic IBTC whatsapp number

To get support over a phone call with a Stanbic IBTC bank customer care representative call any of the following lines:

General enquiries: +234 1 422 2222.

Fraud cases: +234 1 4227777

The support phone number is available 24 hours daily, from Mondays to Fridays.

You must take note that those lines are not toll-free. In other words, you will need to have enough credit to pay for every second/minute you spend on the call. And as we all know, some network providers in Nigeria offer very expensive call rates to landlines. Therefore it is not advisable to use the phone numbers if you don’t have enough credit.

Stanbic IBTC Bank customer care email address

To receive support via email, forward your inquiries, requests or complaints to [email protected]. If you intend to treat fraud-related cases, then send your email to [email protected].

There’s no specific wait-time for replies from customer care representatives. But typically they reply within 24 hours of your initial contact.

To chat with a Stanbic IBTC bank customer care representative, get in touch with using the official Twitter handle or official Facebook page.

Live Chat provides a good alternative for anyone who’s not willing to waste money on voice calls. And in most cases, you should receive a response within a few minutes.

Stanbic IBTC Bank is yet to make known to customers their official WhatsApp number

Stanbic IBTC internet banking app download

Below are direct link to download Stanbic IBTC bank mobile app. Download the app and login with your internet banking profile ( the username and password you created above.

Stanbic IBTC asset management

Stanbic IBTC Asset Management is an award-winning financial institution offering an array of advisory and investment services ranging from traditional assets: equities, fixed income securities, and mutual funds, to alternative investment offerings including but not limited to unquoted equities as well as private equity options.

Leveraging cutting-edge technology, they remain committed to offering clients quality service through their team of wealth management advisors with real-time online access to investment opportunities.

We provide expert financial advice and invest on our clients behalf in the following vehicles:

- Nigerian Equity Fund

- Ethical Fund

- Guaranteed Investment Fund

- Money Market Fund

- Bond Fund

- Exchange Traded Fund.

Stanbic IBTC ez cash

What is eZ Cash? This is a term loan that offers eligible active current account holders, instant access to funds ranging from N20,000 up to N4,000,000 for a period of 12month, anytime, anywhere with no documentation required.

eZ Cash enables you to have a Cash Account in your mobile phone which you can top-up and carry out a range of cash transactions direct from your mobile phone. You can also withdraw money from your eZ Cash account. eZ Cash is, … Cheapest way to transact with cash. This product was made with you in mind. EZ Cash gives you funds ranging from 20,000 Naira to 4,000,000 Naira at an interest rate of 2.5% monthly to pay back within 12months.

Stanbic IBTC self-service

Stanbic IBTC self-service comes in different forms;

- USSD Banking – *909#

Our USSD banking solution uses basic mobile phone technology to help you access financial services without the need for internet - Internet Banking

Get access real-time balances and statements, make payments, buy airtime top-up, redeem western union and manage your money without going into a branch - SMS Banking

Welcome to 3S Banking! This is our SMS Self-Service solution that offers you convenient access to select financial services by sending commands via SMS to a designated number – 30909, from your registered phone number with the bank.

To onboard via USSD, dial *909*30909# from your registered phone number and follow the prompt

To onboard via the Stanbic IBTC Mobile App, log -in to the ‘My Bank’ module, click on profile and select ‘3S Banking’

To onboard via Internet Banking, log-in Internet Banking platform and select 3S Banking